TRADING PLATFORMS: Getting involved in stock investing can be an exhilarating experience, especially when you consider option trading. But the important factor that users often fail to consider is that selecting the best stock option trading platform is very essential so that the profits that one earns and the loss one avoids are both maximized. Below is a checklist containing key points to ensure that you only invest in the appropriate trading platform.

Understanding Stock Option Trading

With the tips in mind, let’s seek to answer a basic question: What is stock trading all about? Stock options as a form of trading instruments can be defined as the financial instrument which gives the purchaser the right, but not the obligation, to buy or sell the shares of a definite company at the agreed price and for the agreed period. Some of the valuable functions that products can perform include acting as hedges, income earners, and speculations. Given this, it becomes wise to have a good trading platform, and this makes them very important.

A reliable forex trading robot is every trader’s dream come true. Reliability ensures that the bot performs seamlessly, even in volatile market conditions. By opting for a reliable forex trading robot, you can trade confidently, knowing that your investments are in safe hands and backed by cutting-edge technology.

Key Factors to Consider

1. User-Friendly Interface

Firstly, it is essential to have an interface that is easy to navigate, meaning that it should be easy for young players who are not so experienced with computers and similar devices. Something as simple as a complicated platform can result in misapplications and lost chances.

Intuitive Navigation: Ease of navigation refers to platforms where one can get the proper navigation of the sites without any difficulty.

Educational Resources: Some websites provide tutorials, webinars, and guides for people who would like to get acquainted with DAOs more.

2. Fees and commissions

Trading expenses may easily cut into your profit and give you losses in the end. This is why learners must always grasp the fee structure.

Commission Rates: Look to see whether the commission rates for the buying and selling options are comparable or not.

Hidden Fees: Be cautious of some costs that are not explicitly stated, like the charges for maintaining the account or the fee that comes with the privilege of using some of the tools that are available on the market.

3. Range of Available Options

Investors should do proper research to ensure the platform has many stocks available for them to invest in.

Diverse Asset Classes: The platforms for conducting stock options should allow users to work with different types of assets.

Exotic Options: Some platforms may provide options for complex financial assets, such as binary options or exotic derivatives.

4. Research and Analysis Tools

That is why the concept of trading and analyzing requires efficient research and analysis platforms.

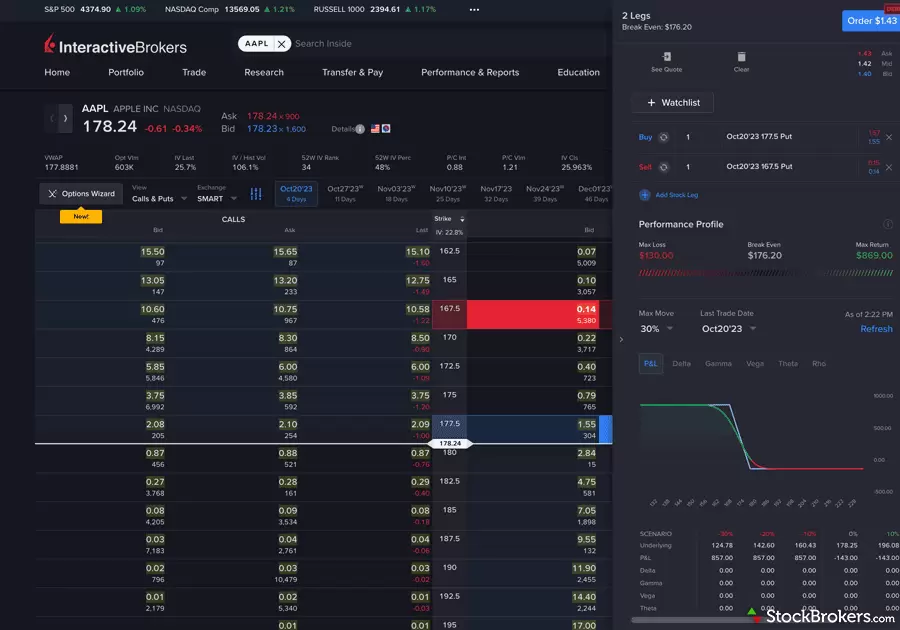

Technical Analysis: Later, to improve analytical capabilities, look for platforms that have rich charting capabilities with technical indicators.

Fundamental Analysis: In this case, the usefulness of platforms providing data on the companies, as well as the analysts’ ratings and the market news, can be invaluable to you.

- Customer Support

The basics of customer support include being able to offer reliable assistance to both you and your customer.

Availability: Check that support is available through phone or online chat around the clock.

Multiple Channels: Some of the good related support is available through phone, e-mail, and live chat.

6. Security Measures

Your data and restricted information connected to money should be safeguarded.

Encryption: Make certain that the platform employs higher levels of encryption to prevent your information from being stolen.

Regulation: Ensure that platforms operating within the platform’s industries are monitored by appropriate financial regulatory bodies.

7. Mobile Trading

The importance of containing a trading platform, particularly on mobile devices, cannot be overemphasized due to the growth of smartphone usage.

Mobile App Quality: You can take the opportunity to build a strong and reactive mobile application to trade.

Sync with Desktop: Make sure it is compatible with the mobile platform. You must preferably use the desktop one for a good experience.

8. Demo Account

A demo account enables you to practice trading sessions without involving real cash; this type of account enables you to gain experience in forex trading without suffering losses.

Risk-Free Practice: It is recommended to start with the demo account to spend some time getting used to the work on the platform.

Testing Strategies: This involves practicing different trading techniques while having simulated rooms or stocks to trade.

Making the final decision

For choosing the best stock option trading platform also depend on the requirements of an individual.

Here’s a step-by-step approach to help you decide:

- Identify Your Priorities: Certain aspects concern specific users including low fees, complex instruments, or the quality of customer care services. And so, it is a must for you to identify your priorities in the firsthand.2. Research and compare: You should employ the above-mentioned factors when comparing different platforms. Perform an extensive or a thorough research before choosing the best stock option trading platform.

3.Read reviews: Check out each site’s features and downsides based on users’ feedback and the findings of specialists. Reading user’s feedback and help you make a great choice.

4. Test the Platform: It’s important to take your time with a forex trading platform, and if possible, open a demo account as a trial before risking real money.

5. Start Small: Starting with a small amount would be recommended once you have selected a given platform to enable you to gain some feel for the properties of that platform.

Conclusion (TRADING PLATFORMS)

To sum it up all, we have presented you with the best stock option trading platforms for you to choose from, as choosing the best is a significant factor in trading. There are some vital elements like user interface, fees, choice of offers, research instruments, customer service, security, mobile trading, and a demo account that must be considered when selecting the right Forex trading platform that could develop the ability to improve your trading expertise. Of course, do not forget to begin by doing adequate research, using the demo accounts, and repeating the choice constantly in the process of your trading. You will also need perspective modifications, depending on the development of your skills and needs. Happy trading!